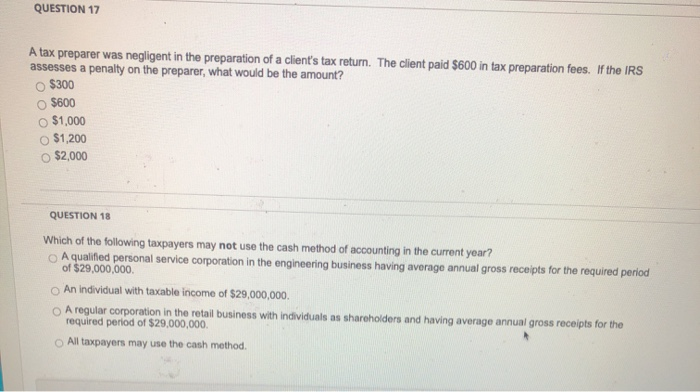

29 Which of the Following Is Not a Preparer Penalty

Which of the following is not a preparer penalty. Failing to furnish a copy of the tax return to the taxpayer can result in a 50 penalty for each violation.

Solved Question 10 Marital Status Is Determined On The First Chegg Com

Failure to furnish copy to taxpayer IRC 6695a.

. Tax preparers may be assessed a penalty for endorsing or cashing a refund check issued to a taxpayer. CTax preparers may be assessed a penalty for failing to sign a tax return. The IRC 6694 b penalty is the greater of 5000 or 75 of the income derived or to be derived by the tax return preparer with respect to returns amended returns and claims for refund prepared for taxable years ending after December 18 2015.

The penalty is 50 for each failure to comply with IRC Sec. The amount of the penalty is generally 20 of the portion of the underpayment amount that is attributable to the prohibited conduct. Etc from the partnerships might be subject to penalties under Code Sec.

Penalty is 50 for each failure to comply with IRC 6107 regarding furnishing a copy of a return or claim to a taxpayer. The preparer provides his Preparer Tax Identification Number but fails to sign a clients tax return. Tax preparers may be assessed a penalty for endorsing or cashing a refund check issued to a taxpayer.

The client will not be subject to a fraud penalty. The section 6695g penalty will not be applied with respect to a particular tax return or claim for refund if the tax return preparer can demonstrate to the satisfaction of the IRS that considering all the facts and circumstances the tax return preparers normal office procedures are reasonably designed and routinely followed to ensure compliance with the due. Which of the following is subject to tax return preparer penalties.

The client will not be subject to a fraud penalty. At a clients insistence the preparer takes and properly discloses a tax position which does not meet the reasonable basis standard. IRC 6694 penalty does not apply.

Which of the following situations will result in a tax preparers penalty. 6107 regarding furnishing a copy of a return or claim to a taxpayer. When they fail to do so they can face any of the following penalties.

Failure to comply with IRC 6060. When a preparer has altered only the direct deposit information on the return and has not changed the tax liability there is no understatement of tax. The CPA may be assessed a tax return preparer penalty.

Applies to tax preparers who fail to follow rules and regulations when preparing a tax return. 6695a Failure to furnish copy to taxpayer. Penalty is 50 for each failure of a tax preparer to give a copy of a tax return or refund claim to a taxpayer maximum penalty cannot be greater than 26500 in calendar year 2020 Failure to sign return IRC 6695b.

While anything is possible particularly when dealing with the IRS and DOJ this article examines why asserting penalties under this scenario might pose challenges. The preparer is not subject to a penalty under Sec. The position was more likely than not to be sustained.

The maximum penalty imposed on any tax return preparer shall not exceed 25500 in a calendar year. 1 The amount of the penalty is per return or claim for refund and is equal to the greater of 5000 or 75 percent of the income derived. The maximum penalty imposed on any tax return preparer shall not exceed 25000 in a calendar year.

Agostino opened the panel by reminding attendees that the United Statess tax assessment system is voluntary. Which of the following is not a preparer penalty. 6695b Failure to sign return.

Sammy is a volunteer who prepares returns at the retirement home under the IRS Tax Counseling for the Elderly program. DTax preparers may be. However the penalty may be doubled to 40 in cases of gross valuation misstatements.

In which of the following cases is a CPA not subject to a penalty stemming from a position taken on a tax return. Accuracy-related penalties generally do not apply to any portion of a. The client will not owe an understatement penalty if the return is audited and the expenses disallowed.

6694 because the understatement was not substantial. He continued by noting that tax preparers along with CPAs and tax attorneys who abrogate their ethical responsibility to that system in favor of helping clients evade taxthe most unpatriotic thing I can think ofare. ATax preparers may be assessed a penalty for endorsing or cashing a refund check issued to a taxpayer.

In the current and proposed section 7216 regulations the term tax return preparer applies not only to the actual preparer of the income tax return but also to others involved with the return such as administrative staff and subordinates who are not and should not be treated as preparers subject to penalty under section 6694. The CPA may be charged with preparing a fraudulent return. Conservation Easements Notice 2017-10 Injunction Action and the Potential Reach of Preparer Penalties.

IRC 6695bFailure to sign return. The section 6694a penalty will not be imposed on a tax return preparer if the position taken other than a position with respect to a tax shelter or a reportable transaction to which section 6662A applies has a reasonable basis and is adequately disclosed within the meaning of paragraph c3 of this section. 6694 because she is not required to examine or review the clients books and records in.

The position had a realistic possibility of being sustained. Tax preparers may be assessed a penalty for failing to keep a copy of the prepared return. Tax preparers are expected to be competent at their jobs and follow certain procedures.

The CPA may be assessed a tax return preparer penalty. If the gross income deduction or basis for a credit is less than 10000. The penalty may be imposed against a tax return preparer if.

Meredith is the director of Federal taxes for a C corporation. Failing to sign a return can result in a 50 penalty per violation. Tax preparers may be assessed a penalty for failing to keep a copy of the prepared return.

I II and III. Civil Preparer Penalties. The position had a reasonable chance of being sustained II.

The client will not owe an understatement penalty if the return is audited and the expenses disallowed. The maximum penalty imposed on any tax return preparer shall not exceed 25000 in a return period. The penalty is 50 for.

The preparer is not subject to a penalty under Sec. BTax preparers may be assessed a penalty for failing to give the taxpayer the preparers workpapers. Abbie prepares her mothers tax returns for 50 a year.

Or less than 400000 and also less than 20 of the gross income on the return or adjusted gross income AGI in the case of an individual a nonsigning preparer will not be considered potentially liable for penalties under Sec. 1 Tax preparers may be assessed a penalty for failing to give the taxpayer the preparers workpapers. The CPA may be charged with preparing a fraudulent return.

The penalty is 500 for a tax return preparer who endorses or negotiates any check made in respect of taxes imposed by Title 26 which is issued to a taxpayer. Tax preparers may be assessed a penalty for failing to give the taxpayer the preparers workpapers. IRC 6695fNegotiation of check.

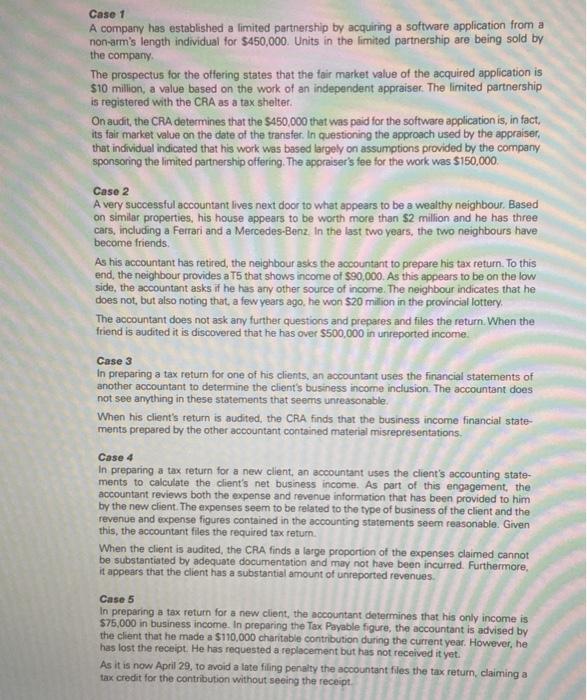

Solved Assignment Problem Two 7 Tax Preparer S Penalties Chegg Com

Solved Assignment Problem Two 7 Tax Preparer S Penalties Chegg Com

No comments for "29 Which of the Following Is Not a Preparer Penalty"

Post a Comment